Simple Tips for Living on One Income – How to Budget and Plan

Published:

April 12, 2021

Contributor:

Carrie

Disclosure: This post may contain affiliate links, meaning if you decide to make a purchase via my links, I may earn a commission at no additional cost to you. See my disclosure for more info.

Having two incomes in the home is a great thing, but sometimes it is just not possible, especially for homeschoolers because one parent is typically home with the children and not employed.

Living on one income can be hard to do, especially as the cost of living continues to rise, but it is totally possible using these simple tips for living on one income.

You may have only had one income for years or you may have suddenly found yourself losing an income and are now lost at what to do.

Whatever the reasons you only have one income, there are things you can do to ease any financial stressors or burdens you may be experiencing from living on one income.

Keep Your Money on a Leash

When you only have one income, you typically do not have a lot of wiggle room in your wallet. This means that if you are spending money without thought or without planning, you could potentially be putting yourself into a bad financial situation.

You can put a plan in place to stop living paycheck to paycheck.

To start, you need to know where every dime is and where it is going. It is work to do this at first and will take some getting used to, but ultimately, you will be glad you did.

If you are not great at doing this digitally, consider using a cash system. Millions of people have gotten their budget on track by using cash only and the cash envelope system. It won’t work for everyone, but if you have never tried it, you have no idea if it will for you or not.

Understand Your Expenses

When you are living on one income, you must be absolutely certain of what expenses you have and when you have them.

If you are not certain what your every expense is and when it charges, you leave yourself open to a charge when you’re least expecting it. This can cause additional costs in late fees or overdraft fees.

The easiest way to keep track of this is with a calendar. Some people will prefer a large desk type calendar or a Happy Planner type budget planner while others will be fine using something as simple as Google Calendar.

Search your bank statements for regular charges such as your power bill, water bill and so on and write the due date and the amount due on the calendar. Check it and update it often to avoid any mishaps.

Know Wants Vs. Needs

It can be fun to buy what we want, when we want or to go to that concert we’ve been dying to go to, but if you’re living on a single income and you are having financial issues, you can’t afford it.

Knowing what your wants are versus what your needs are is key to managing your money when you only have a single income. Indulging in too many wants one too many times is a direct path to financial trouble and stress.

Create a Budget

If you don’t already have a budget, you need one immediately. When you are a one income family, you don’t have the comfort of not running a family budget.

How you budget is entirely up to you as each family will prefer a different method. Some will prefer pen and paper, others will use an app and still others might use a software such as Quicken Home.

The method really is not important as long as it works well for you, however, if you do not already have one, make sure to sit down very soon and create one.

Stick To Your Budget

The budget you create will not do you much good if you are not sticking to it. This one is probably the hardest on this list as a whole lot of people have significant trouble sticking to their budget.

If you are creating a budget, but not sticking to it, you’re giving yourself a false sense of security. You feel secure in your finances because you have the budget, but that false sense of security leads to a crisis because you’re not sticking to it.

You can use a budget planner and expense tracking notebook to stay on track with your budget

Why You Should Over-Estimate Your Expenses

There are very few expenses for a family that are fixed each month. Rent or mortgages, streaming services and such tend to be but your main costs like power and water bills, gasoline costs and so on are variable.

This means they change from month to month. For these expenses, if you do not have the actual amount due, it is best to estimate more than you expect.

For instance, if you think your power bill will cost $350.00, it is best to budget $400 for this amount. Doing so will make sure you are covered if there is a month where this exact situation happens.

Learn to Reduce Your Expenses

There are two constants when you live on one income; an updated budget and reducing expenses. This means that you should always be looking for ways to cut the costs of what you are already paying.

Maybe it’s finding a way to save money on groceries. Maybe this week it is working on ways to lower your power bill. The what does not matter as much as the why.

If you are accepting that your bills are as high as they are, there is nothing to stop you from using more of them and costing yourself more money. When you’re actively trying to reduce them, however, you are keeping it in the front of your mind that your money can only stretch so far and that it needs to stretch as smartly as possible.

Plan a “Cheat” Day

With all of that said, life can not be one big ball of worrying about your money and stressing that you only have one income. You need a day or two a month where you and your family can relax and have fun.

Just because you are living on one income does not mean you can’t do that. It only means you need to plan for it.

Pick a couple of days each month to do something you and your family enjoys. Then, update your budget to account for the costs associated with those family days.

Save the money if needed and when that day comes, enjoy yourself fully. You will be glad you did.

Steps You Can Take To Make it on One Income

In summary, here are the steps your family can work through to start living a budget-friendly life one one income.

- Keep Your Money on a Leash

- Understand Your Expenses

- Know Wants Vs. Needs

- Create a Budget

- Stick To Your Budget

- Over-estimate Your Expenses

- Learn to Reduce Your Expenses

- Plan a “Cheat” Day

Helpful articles about creating a budget, sticking to a budget, and saving money:

- How to Create a Homeschool Budget

- Tips and Ideas for Making Food Last on a Budget

- 35 Things You Can Do for Fun on a Shoestring Budget

- FREE Curriculum Shopping Budget Printables

- How to Homeschool on a Tight Budget (with FREEBIE strategy guide!)

- Ways to Help Kids Learn Good Budgeting Skills

- FREE Vacation Fun Planning Pack to Afford Traveling on a Budget

- FREE Household Budgeting Printables

- The Easy Way To Raise A Money Genius

- Personal Finance Courses for Teens with Best Money Academy – Teenz Money Review

- Activities to Teach Kids About Money

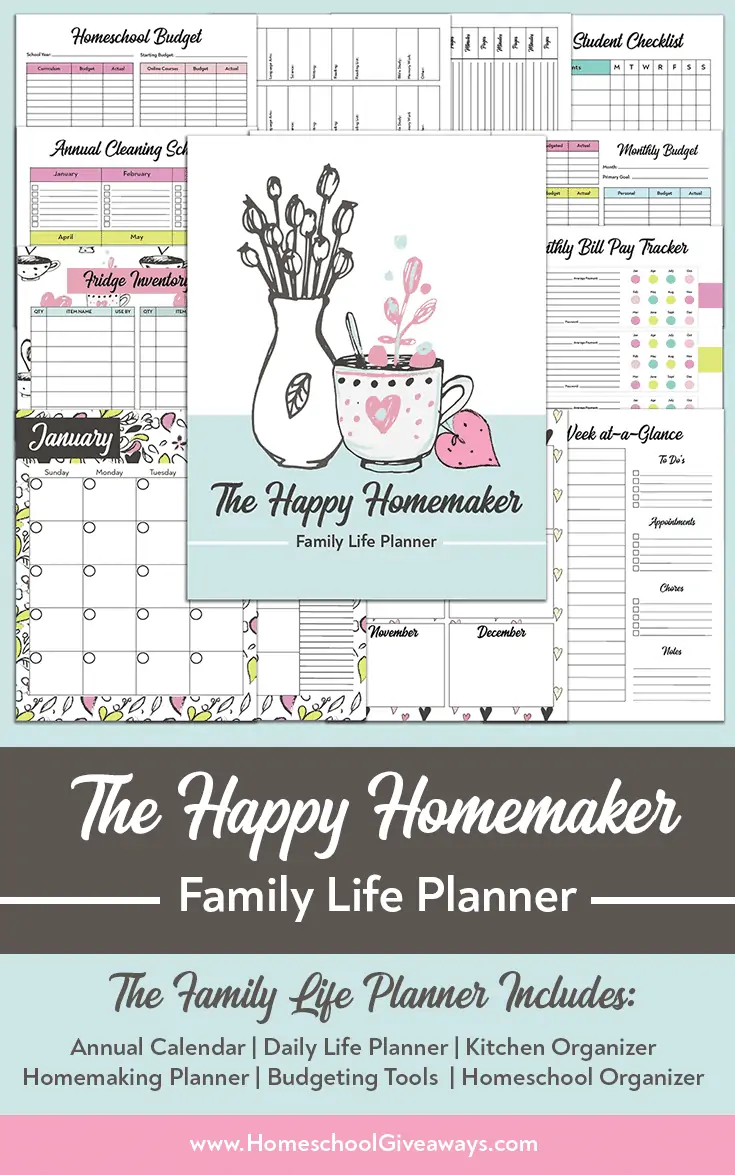

You can find a bunch of templates that can be used for tracking expenses and creating (and sticking) to a budget in our FREE Family Life Planner.

The Happy Homemaker Family Life Planner is an easy-to-use planner for all areas of life that contains dozens of printable templates:

- Calendar and Planners

- Kitchen Organization & Menu Planning

- Homemaking Helps

- Homeschool Organization Tools

It’s available for FREE to Homeschool Giveaways subscribers. You can access it in our subscriber library that contains more than 25 free resources for homeschoolers or on this page with the password (found at the bottom of all our emails).